Plan for life’s opportunities

Baby to Young Adulthood

Post-secondary education is the primary goal of most parents: Offering the gift of an education to their children and grandchildren. While 529 College Savings plans are the most popular, they are not the only vehicle for some goals in the “early years.” Some parents and grandparents create brokerage accounts, Roth IRAs or UTMA accounts for purposes that go beyond post-secondary school, such as an eventual home purchase, etc.

Young Adulthood

Understanding is at the heart of financial planning. We help you uncover opportunities for your future by asking questions and collaborating with you with digital financial tools. In designing a flexible financial plan for you, we can help you determine how much to save, review investment options for your retirement plan, and explore ways for you to insure your income.

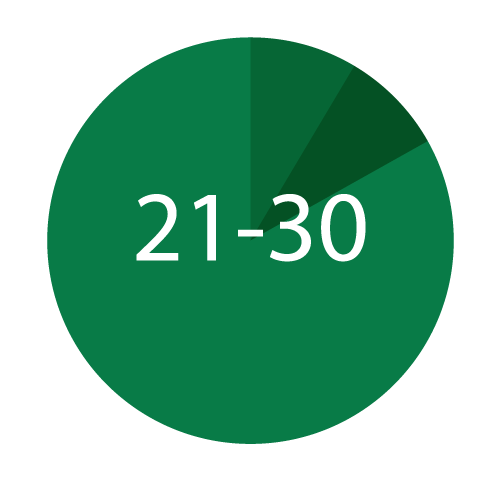

Early Middle Age

We offer options to help you save for your child’s post-secondary education. Additionally, we can help with strategies for tax-aware investing as well as investments that are socially responsible.

We will work with you to create a plan for multiple opportunities, including caring for aging parents, all the while helping you move toward achieving financial peace of mind.

Middle Age

We aim to provide consistent service, robust digital tools, and planned financial reviews. We rely on processes to guide an investment mix and insurance products geared toward your unique situation. We provide options and help educate you, bringing perspective to a period of many goals, objectives, and plans.

Early Senior Years

Throughout client relationships, there are points where we pivot, anticipating life changes that require guidance, planning, and patience. With clients who are nearing retirement, we meet more often, refine financial plans and products, help set realistic expectations, and tailor investment products to provide income and growth.

Senior Years

We have geared our practice to understand clients who are beginning to enjoy the fruits of their labor. You may have bucket lists and have been busy building a nest egg for retirement.

We meet clients who also have thoughts not yet on paper about legacies and how much can safely be withdrawn from retirement accounts. We also are proactive with multiple generations of families, meeting the next generation and encouraging smooth transitions down the line.

Our financial planning tools can help you with tax optimization for various accounts you may have. You can work with us to explore multiple scenarios for your income, beneficiaries, and account registrations, including any future plans or education accounts you may want to provide for.

The Financial Advisor associated with this profile may only discuss or transact business with residents of states in which they are properly registered. No offers may be made or accepted from any resident of any other state. Please check FINRA’s BrokerCheck for a list of current registrations. Securities and advisory services offered through Commonwealth Financial Network® , Member FINRA / SIPC, a Registered Investment Adviser. Fixed insurance products and services are separate from and not offered through Commonwealth.

BrokerCheck is a free tool to research the background and experience of financial brokers, advisers and firms.

Check the background of this investment professional.